Breaking Down RBC's Constellation Software Mega Report

Pricing In A "Wipeout Scenario"

Another down day for software -3%. All those charts in my previous post are even worse. Blood in the streets!

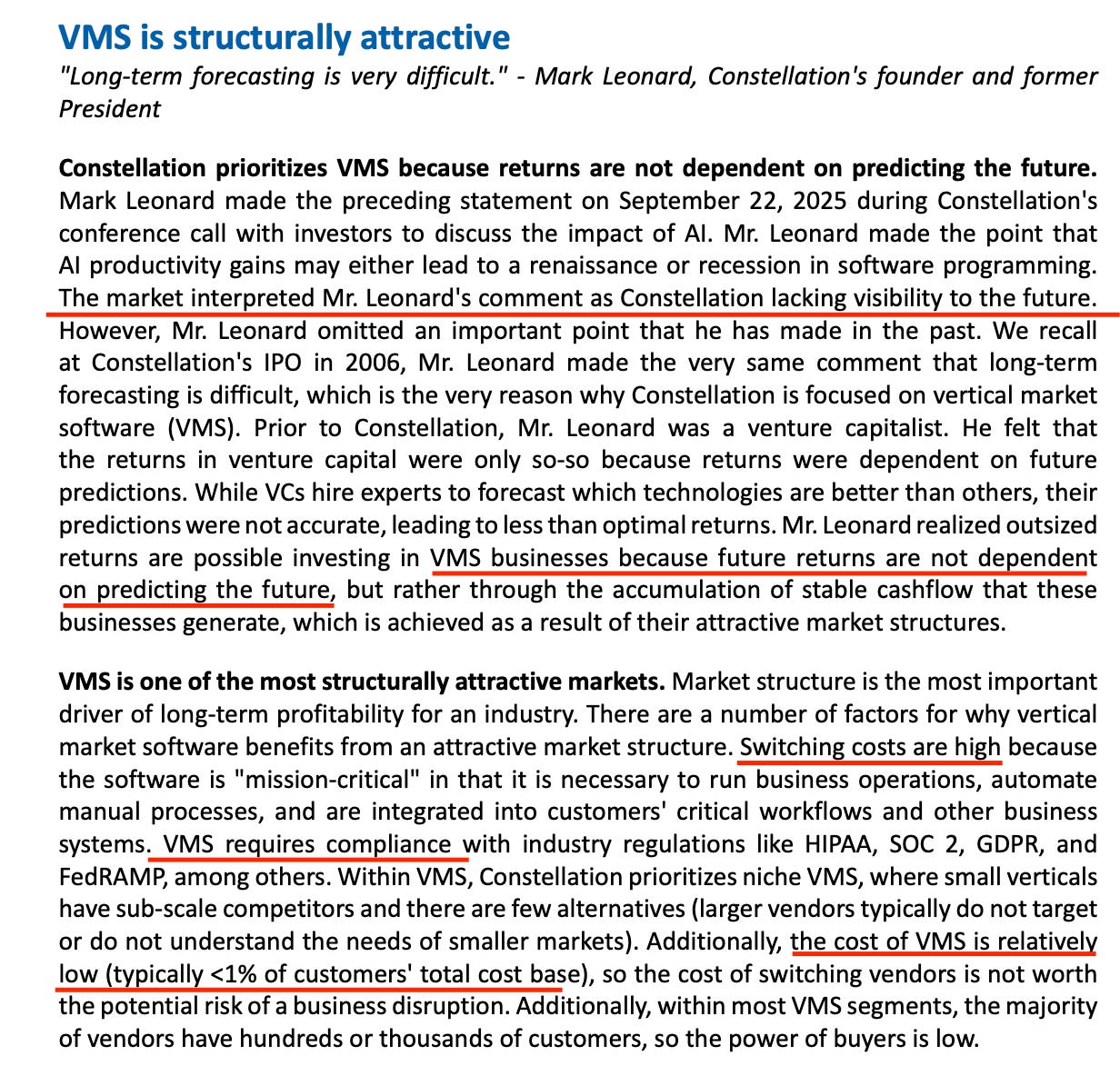

RBC put out a 32 page monster update today on CSU, maintaining their market outperform rating with an unchanged target price of $4800.

They had a $6000 target price a few months ago and keep hammering down their estimates and multiples to make the numbers work and not look unhinged to Bay St consensus (read: career risk; which I get!)

Nevertheless, they are clearly favourable on the shares and believe they are currently pricing in a “Wipeout Scenario” (with some extreme assumptions!), so let’s dive in.

Here are their key points.

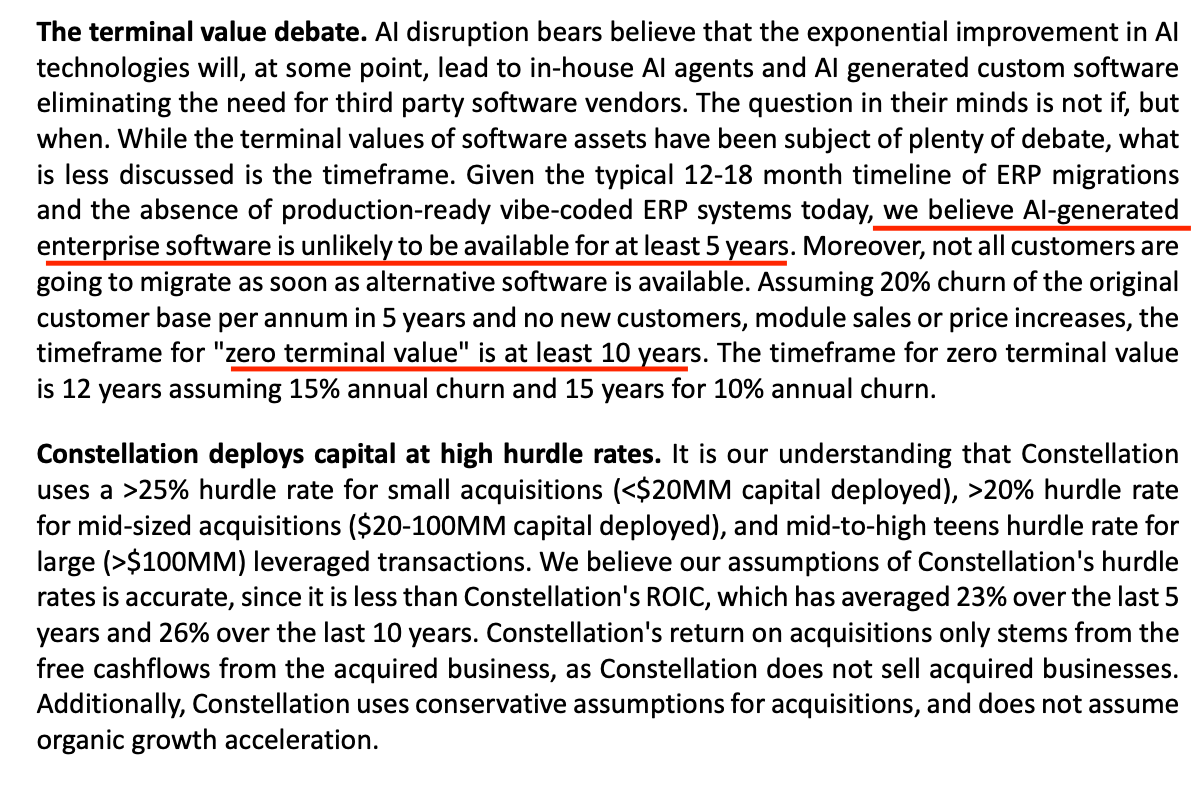

VMS is Not Dependent On Terminal Values

The first point is a familiar one: VMS or vertical market software is fundamentally different than general or horizontal market software. In fact, it was chosen by Mark Leonard specifically because it was not dependent on knowing the future.

This is largely what I see as well. The risk of disrupting Docusign or even Adobe vs CSU’s 1100+ deeply ingrained VMS firms is extremely different yet all software stocks are down equally.

Price Is My Due Diligence

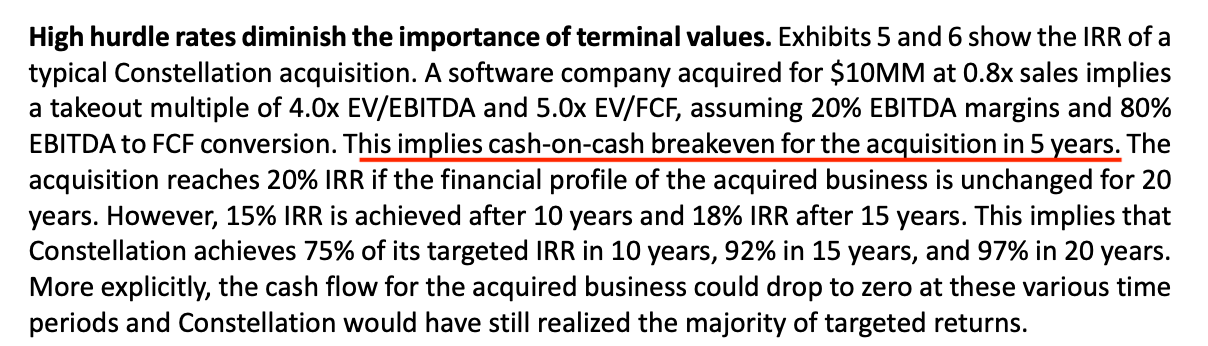

RBC argues that the market is overestimating how quickly customers could churn off existing software vendors, arguing “AI generated enterprise software is still 5+ years away”.

In addition, they hit home on how CSU’s disciplined acquisition hurdles means that even if AI does disrupt software, CSU will get most of its money back on acquisitions, with a 5 year cash on cash breakeven.

Another point (of mine), is even in a doomsday scenario for VMS, the company can pivot into other verticals. Constellation is a great company because of its culture not just because it identified a fantastic industry 30 years ago. It is literally poor Charlie’s Almanac in corporate form. Mark Leonard almost bought a thermal oil company in the pandemic before prices rebounded. Don’t forget the optionality in a world class acquisition platform.

This Isn’t Constellation’s First Disruption

RBC argues that at its heart AI is just a continuation of programming languages improving and that in prior tech shifts like Cloud, Constellation has continued to prosper with its existing clients.

When Certainty Is Everything (99% isn’t enough!)

RBC argues that by its very nature, AI cannot provide 100% certainty which is actually what VMS customers require. In addition, because the data sets are private, CSU is already in the best position to deliver new features vs a new AI entrant.

Software Vendor vs Humans (Fire Some Humans First)

RBC talks about exactly what Mark Miller said on their AI call in the fall. As existing moats (in this case coding cost) fall due to AI, new AI enabled ones are added.

And while the market focuses on software spend declining, the real focus should be on what it can enable. They calculate that the cost of software is so low presently $5,000 per employee vs $66,0000 in labour cost per per employee that the focus should be on using software to reduce the number of employees vs reducing the cost of software.

I’m also a big believer in AI following Jevon’s paradox. I think the software industry will be far bigger 5, 10 and 20 years from now. The software industry won’t decline like newspapers, more technology is where the economy is headed.

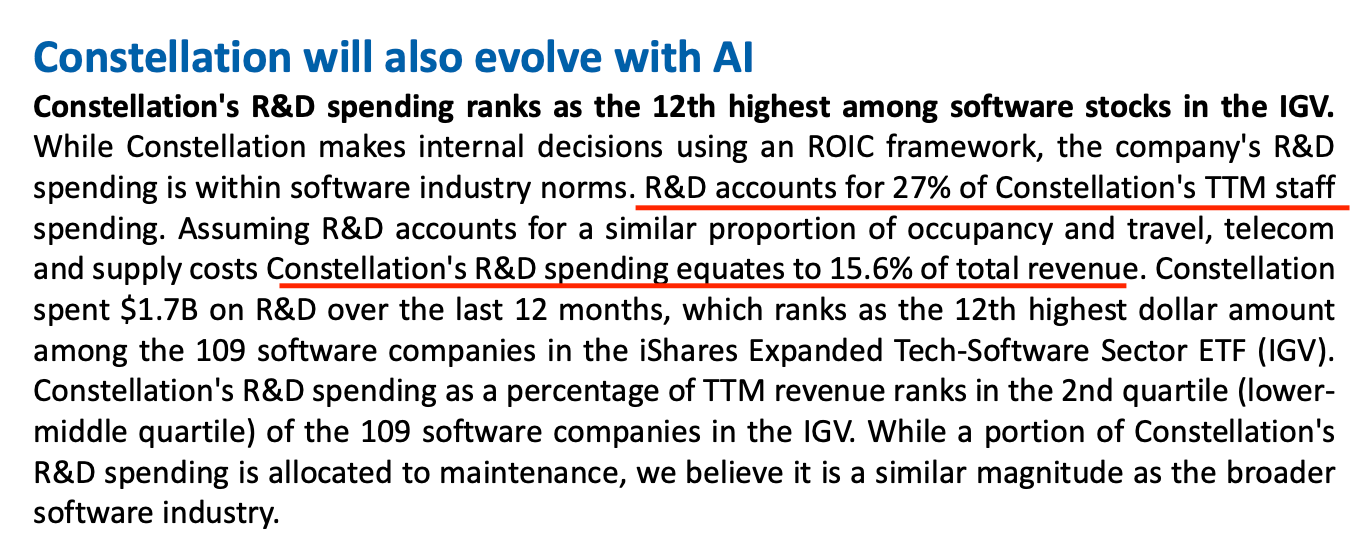

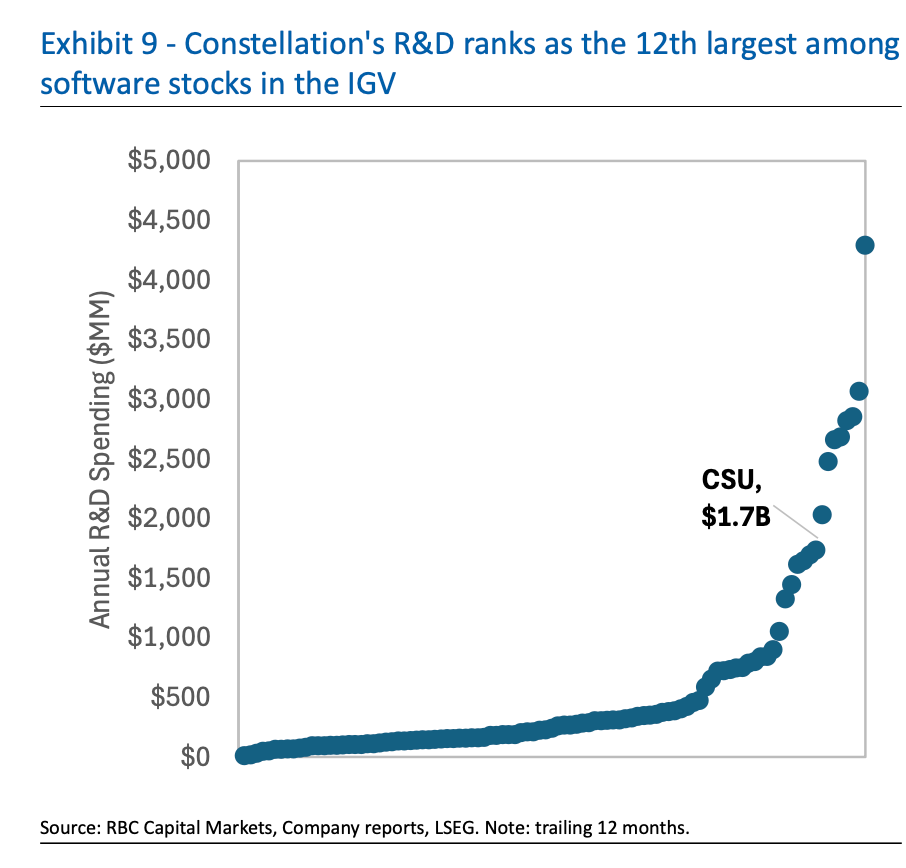

Constellation Investing Into AI

Far from sticking their head in the sand, RBC believes that constellation is heavily investing into future software features.

On a side note I was actually surprised to see a podcast recently where a Constellation head was saying they had been experimenting with AI since 2016! I swear if Constellation added .AI to their name and explained how they were embracing the technology the stock would jump 30% (won’t happen though; they like the share price being low given they force leadership to buy in the open market every year).

Decentralization Leads To More Innovation

Unlike top down organizations, Constellation has 1100 entrepreneurs being incentivized to use AI effectively and share their findings.

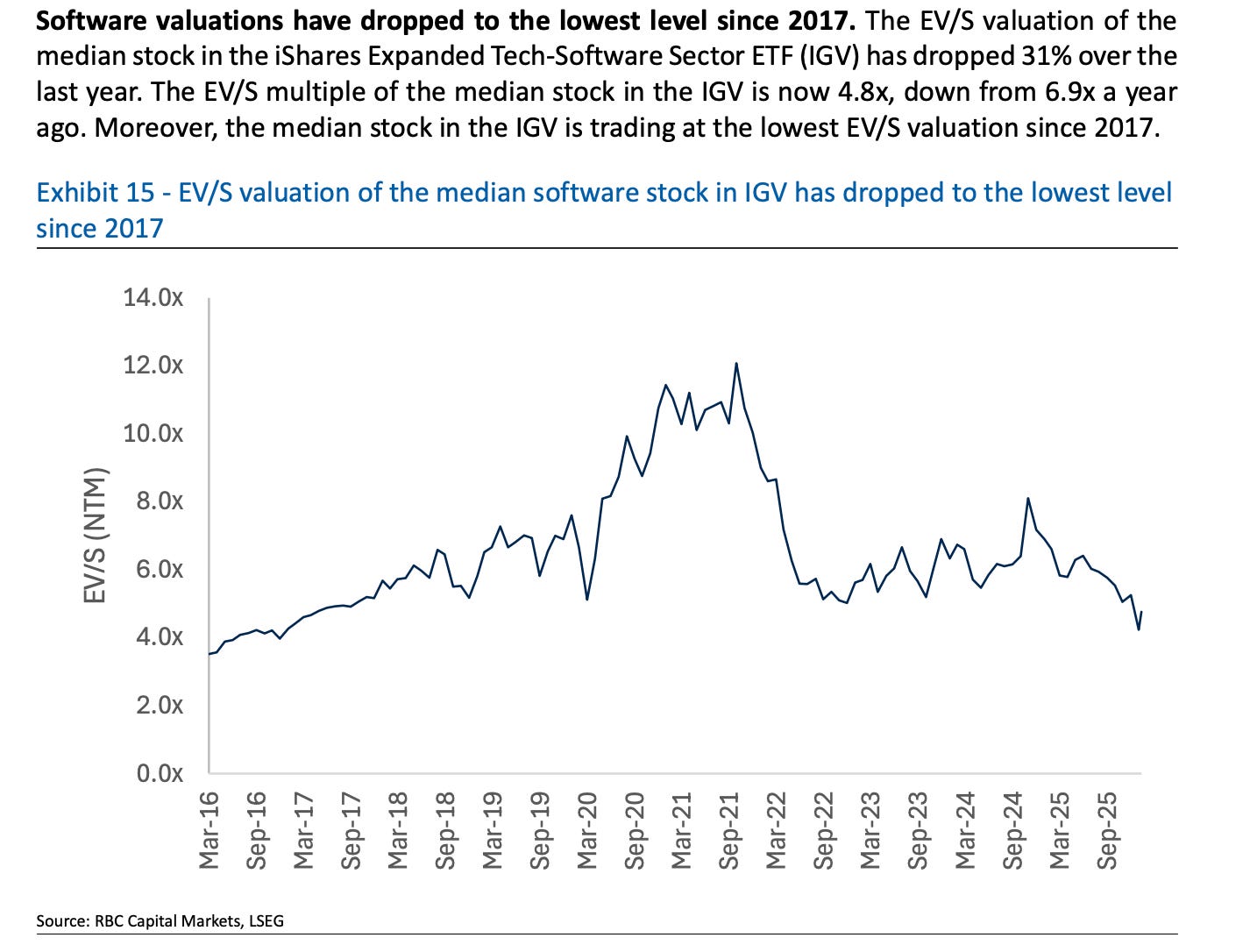

The More Software Crashes The Better

RBC runs through CSU’s hall of fame returns and how its growth through acquisition strategy has played out and thus if software multiples are collapsing then future capital allocation deployment opportunities and IRRs are going to sky rocket!

Roper mentioned this on their conference call as well that private-equity-owned software assets are under unprecedented pressure to provide liquidity.

The capital is drying up and CSU is one of the few remaining buyers!

Markets Are Pricing In Overly Pessimistic Scenarios

RBC runs through 3 different valuation scenarios. At $2200 here, the market is pricing a “Wipeout Scenario” where organic growth drops from +2% to -10% and ZERO acquisitions take place from 2029 to 2034.

And that’s where the stock is at today. A top 1% compounder with a proven business model over 3 decades of capital allocation is being priced with double digit declines in organic growth and zero acquisitions. The stock closed today at 17.5x TTM, and 13x their 2027 estimates vs 29.5x TTM for the S&P 500. Never thought I’d see that divergence in my career.

This is a company that 2 years ago The Economist was calling the Tech’s Berkshire Hathaway (and the numbers haven’t been impaired here, just a misunderstanding of how AI will affect VMS).

Shoot first, ask questions later.

Wild times!

Trevor

Vertical Enterprise software will likely not be replaced with AI but I think software business model / pricing model will evolve. Deterministic software with domain knowledge will be tough to break. As AI gets better and faster, the ARR will go down due to number of people using it or seats going down. The bigger question is whether the usage based or tokenized model will have the same economics as a cloud SAAS models.

Nice work here, appreciate you compiling this. I don't really understand why the wipeout scenario assumes 2% organic growth for the next three years. Isn't there a more bearish scenario than that? VMS starts shedding seats in 2027 and 2028?

Don't get me wrong, I think $CSU is very compelling here. I just don't fully understand why there isn't a worse outcome in the short term.