SaaSpocalypse

Finding babies in the bathwater

Software is bad, the worst I’ve seen in my career. (and down yet another 4% today).

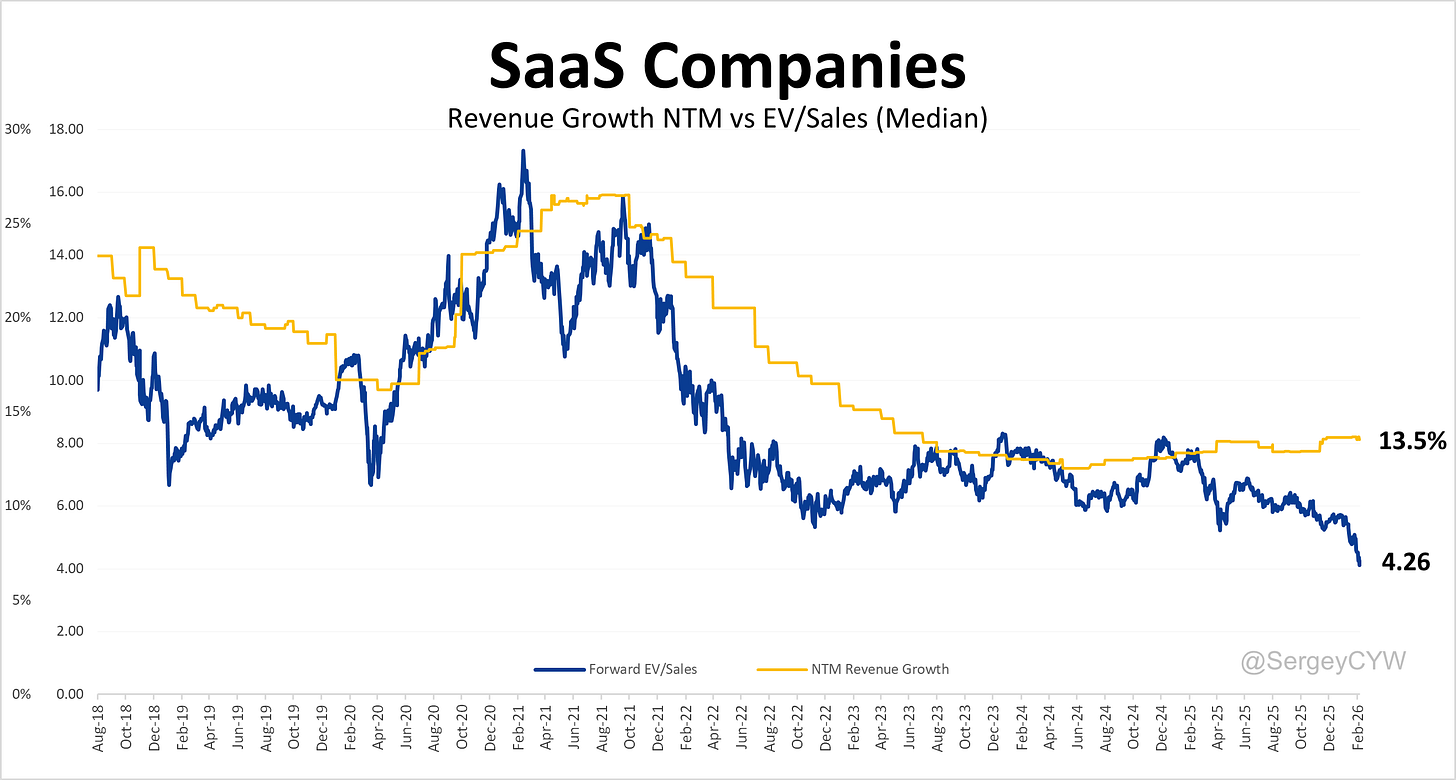

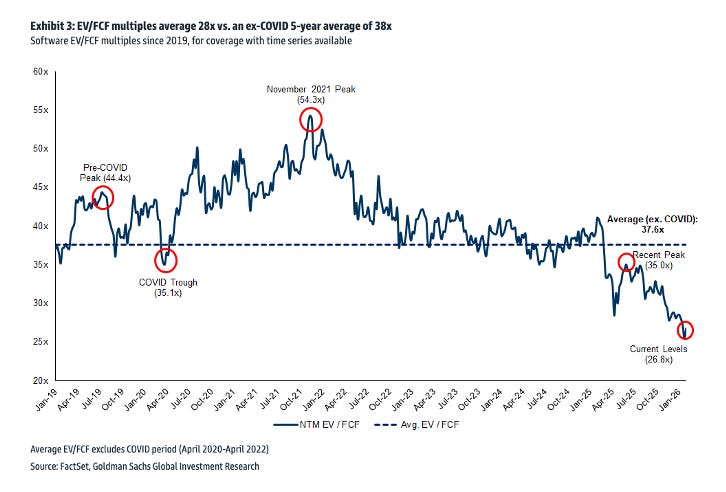

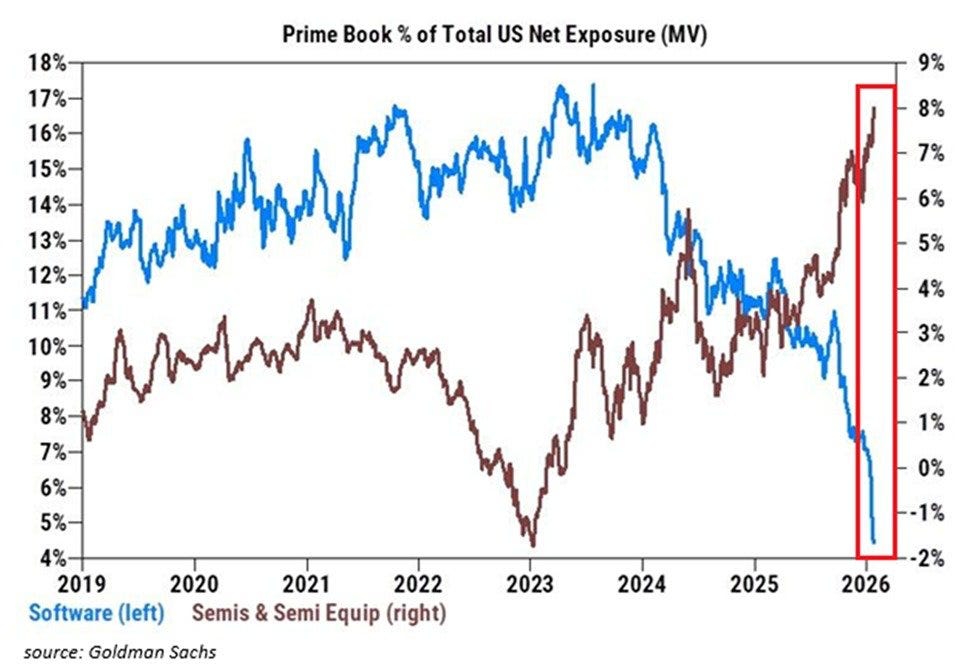

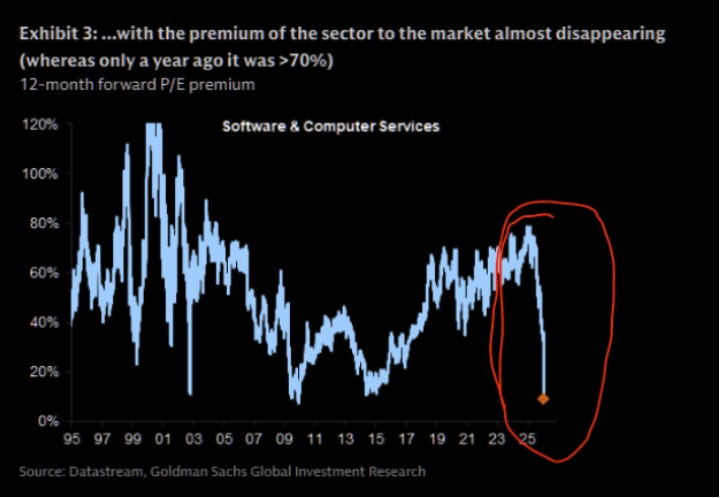

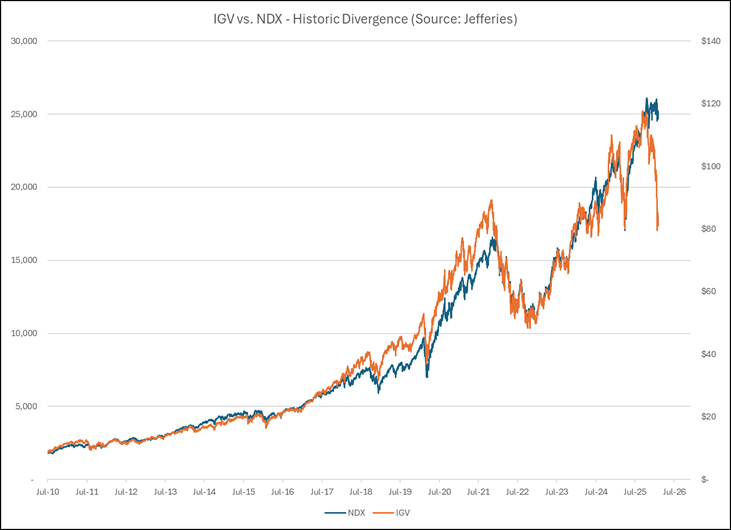

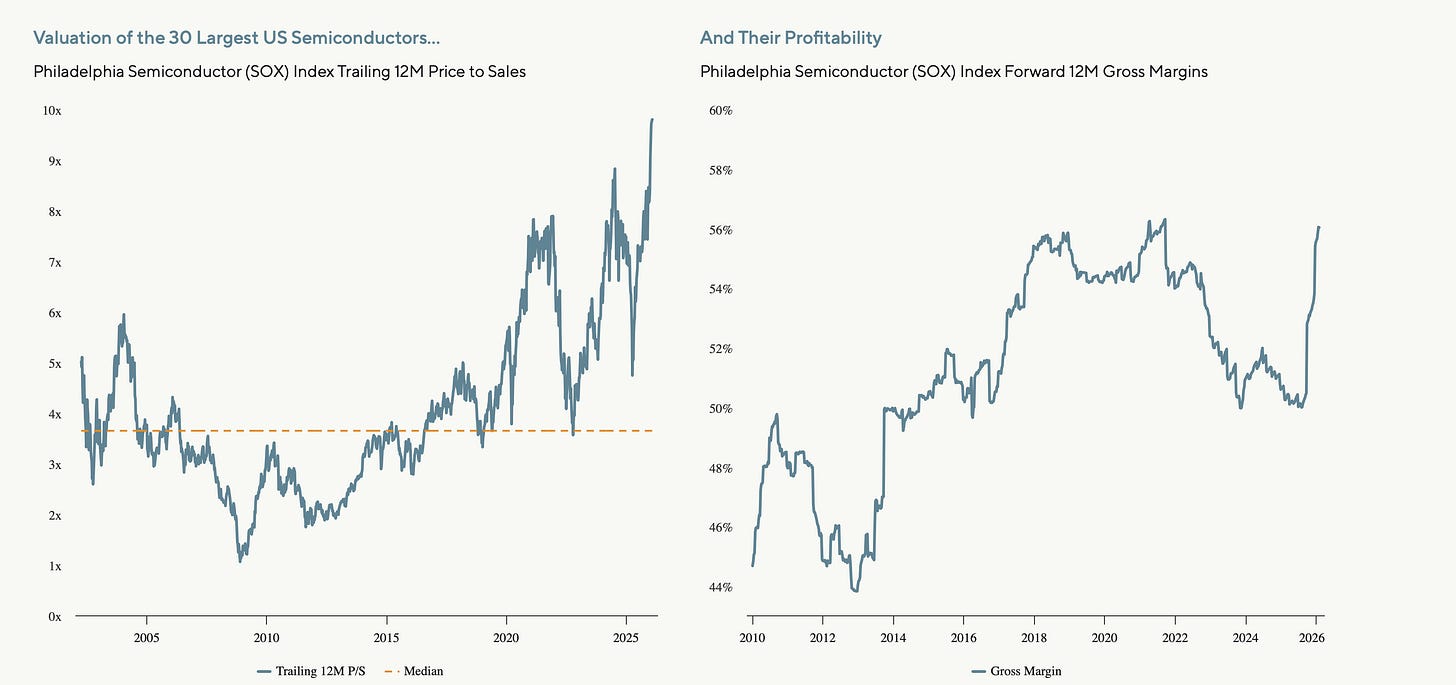

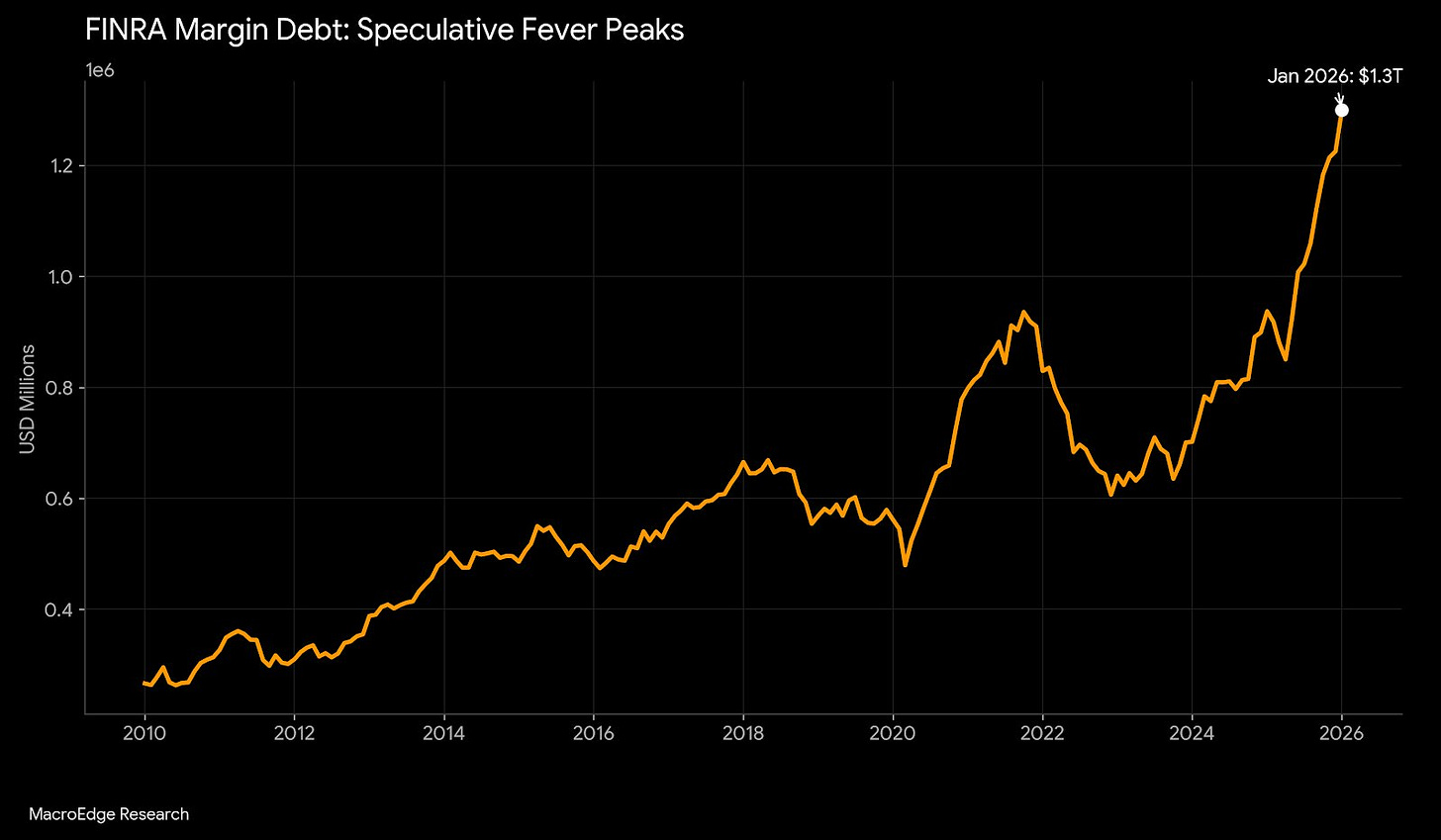

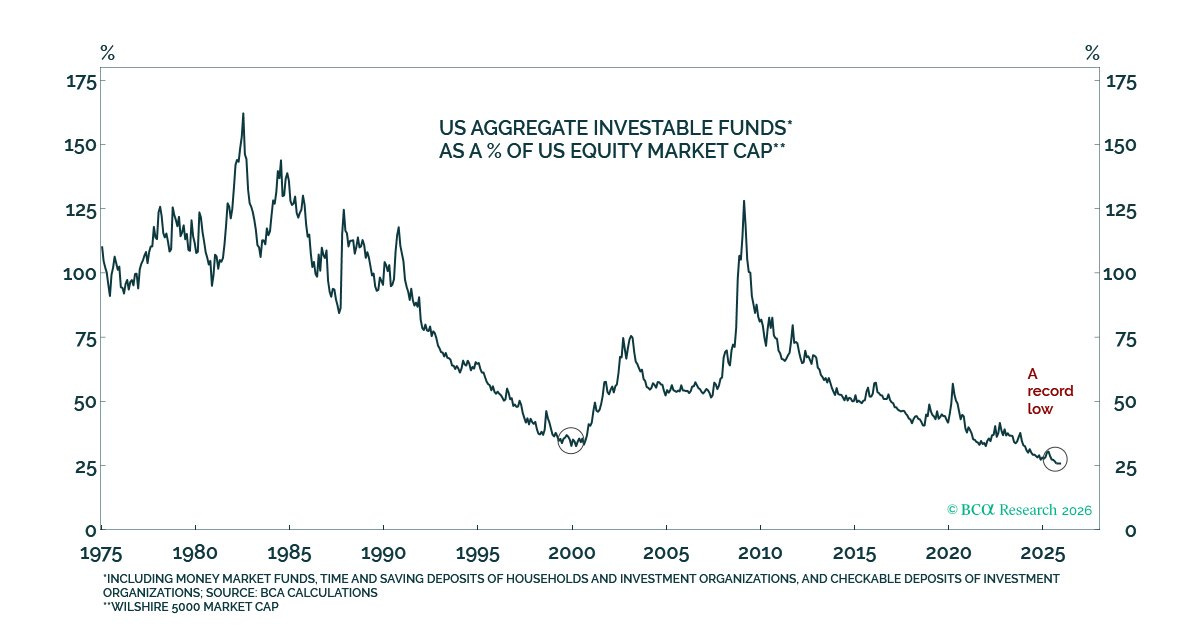

Here’s some charts (all of which have gotten worse since they were published)

Semis are on fire, Google just issued a 100 year “AI bonds” that investors couldn’t get enough of.

This is a chart of the Software index ($IGV) vs the Semi ETF ($SMH).

Software returns vs semis have literally never been worse.

I personally think these tech bros over dosed on reading The Outsiders (nearly all of them have admitted as much too).

Margin debt is jumping so perhaps we are just nearing the end of a massive bull run. Time will tell by.

I really enjoyed this article on the AI bear argument by Michelle Celarier.

However, the only question we need to ask: is there anything cheap here?

I think the death of software bear thesis is massively overblown. The idea that Becky from HR is going to vibe code a new CRM database and replace Salesforce seems highly unlikely.

There’s certainly other cheap software names but Constellation and Topicus are next level on capital allocation and management and have the highest fcf yields with similar growth to the sector. Also, Constellation and Topicus have no stock options unlike nearly every other firm which just ignore the massive expense in their guidance.

I figured getting back in to the names after they had their AI call and Mark Leonard had stepped down would be great timing however, I was far too early although I don’t think it matters much long term, just very painful short term!

Vertical Market Software just seems like such a safer place in software given its deep integration relative to one off or simple SaaS plays like Docusign, Chegg or Duolingo features that AI generally seems a massive threat to.

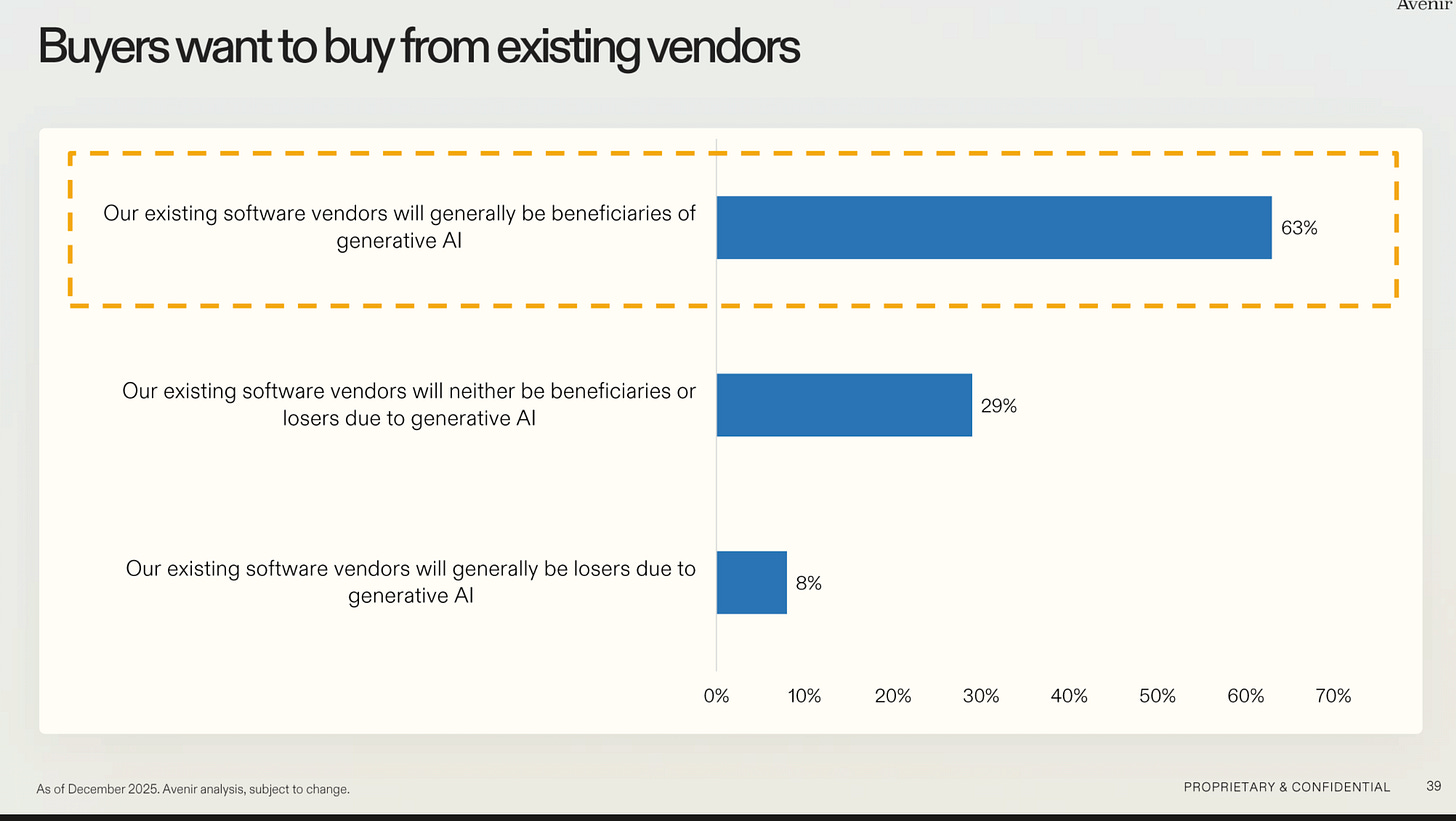

The TL;DR is VMS firms don’t compete on coding cost, they compete on trust and reliability. Survey after survey shows that customers are more likely to trust existing vendors to implement new AI tools.

This is hardly surprising, CSU has been in business for over three decades and successfully navigated multiple software revolutions. As historical services get commoditized new tech enabled services get layered on.

As Mark Leonard said in September.

”I believe that vertical market software is the distillation of a conversation between the vendor and the customer that has gone on frequently for a couple of decades. And you distill those work practices down into algorithms and software and data and reports and it captures so much about the business. And being able to examine that in a new way because of AI, creates new opportunity to modify and change and suggest new approaches. So yes, I'm hopeful that, that unique and proprietary information will be of value.”

The stock is in the tank, and unless I’m terribly wrong I just don’t see how these can’t compound at very high rates from here with little capital impairment risk.

There’s a scenario where if the AI narrative ever reverses then a lot of these software names could rally even in a bear market.

At its core you you have a top 1% compounder, at a multi decade low valuation, with multi million insider buys from the new CEO, world class management, yielding twice the 10 year yield and likely growing at least mid teens for many years (potentially even better as growth could now surprise on the upside given software acquisition prices are collapsing).

Anyways, here’s the Constellation and Topicus Globe & Mail article (PDF)

I will try and write more going forward! Might throw in some of my work with Tegus calls.

Good write-up. As someone that has followed CSU and Mark Leonard for a long time, been in software and even implemented and hold patients with AI, I think two things stand out more salient for me in this SaaSpolypse for CSU and VMS in general:

1) individual business units who are lightly integrated and aren't truly mission-critical will go the way of the Dodo bird

2) those that are truly mission-critical will benefit from the tailwind that is better, faster, stronger ways to build and architect software

I think people need to see the literal forest for the trees. CSU is that forest with dozens of groves (verticals, operating groups) and like in nature, will some die!? Will CSU need to do some controlled fires!? Will they need to be propogated? Will need to plant some new growth over here or there? That's what people miss when it comes to lumping CSU with the other software companies.

But make no mistake. Markets are doing what they do best: price discovery. And the software category is maybe becoming put in the "Too-Hard" pile (as Mr. Munger would say). I don't blame them at all and would agree.

Thanks for the write up. There is a lot to like about CSU and TOI in the software space, especially the way they keep their share counts constant unlike almost every other name in the space. For me, the valuation had been quite rich previously. However, there are some questions I'm still grappling with:

- Why are the private companies they buy at 2x sales are suddenly worth 5x sales under their ownership at current prices?

- How much runway is left for CSU at sales north of $10B for growth by acquisitions? This is less of an issue with Topicus.

- What would be a "no brainer" valuation of these companies? Topicus is still 2.5% fcf yield on ttm reporting. Even at current prices and on a forward basis, fcf yield is barely MSD. That's still pricey for me.