It’s been ages since I’ve done a substack post but it’s Saturday morning and I felt like writing, so here we are.

Everybody knows the Berkshire annual letter but fewer go through the Fairfax one.

Given how much I’ve already talked about Fairfax previously, I don’t feel like devoting our Q1 letter to the subject yet again so I thought I’d cover the highlights here. Just to be clear, I’m not in the stock because I’m in some Fairfax cult (Tidefall has many other positions). I’m in the stock because I think it’s very cheap and has great long term prospects.

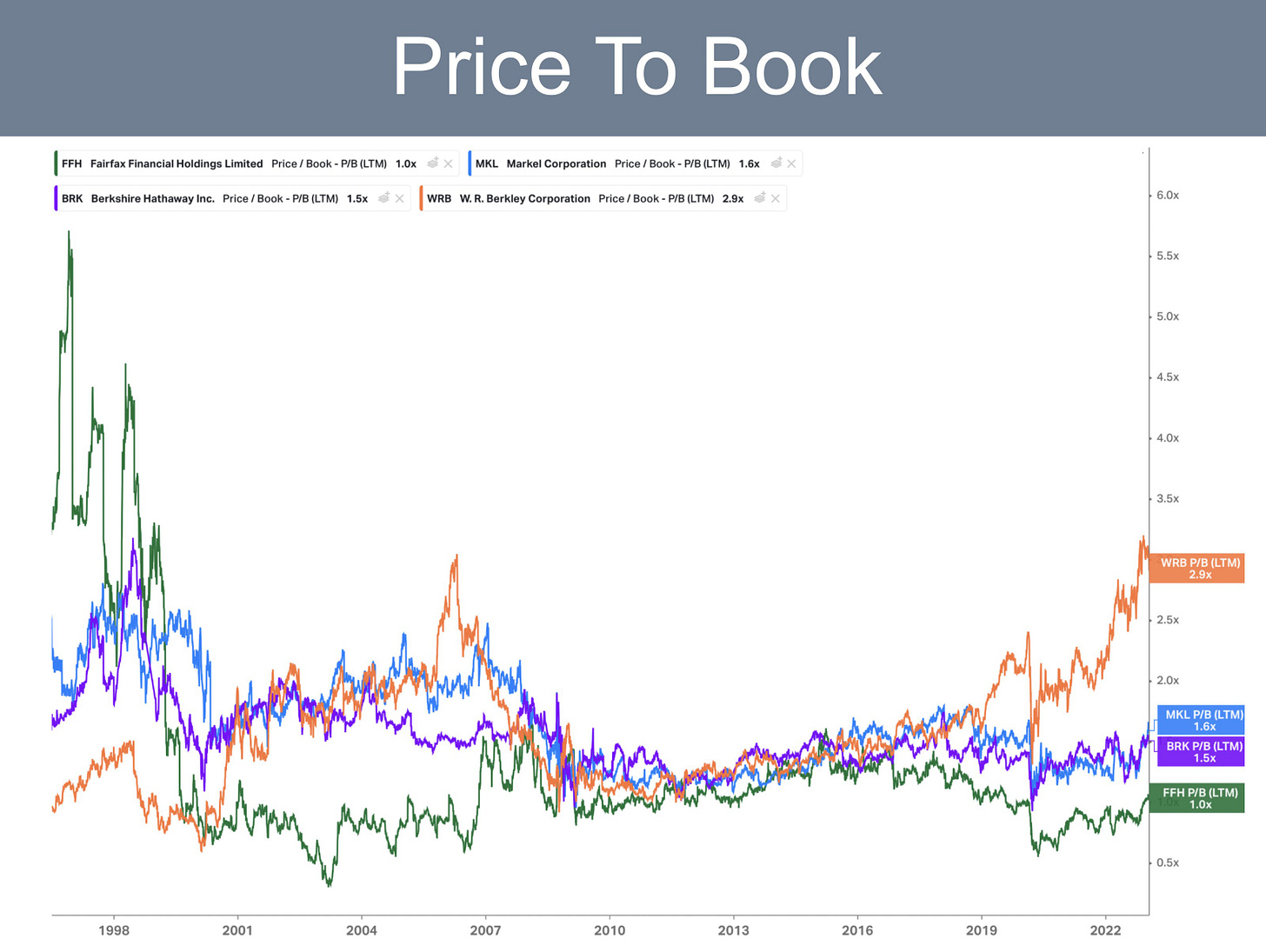

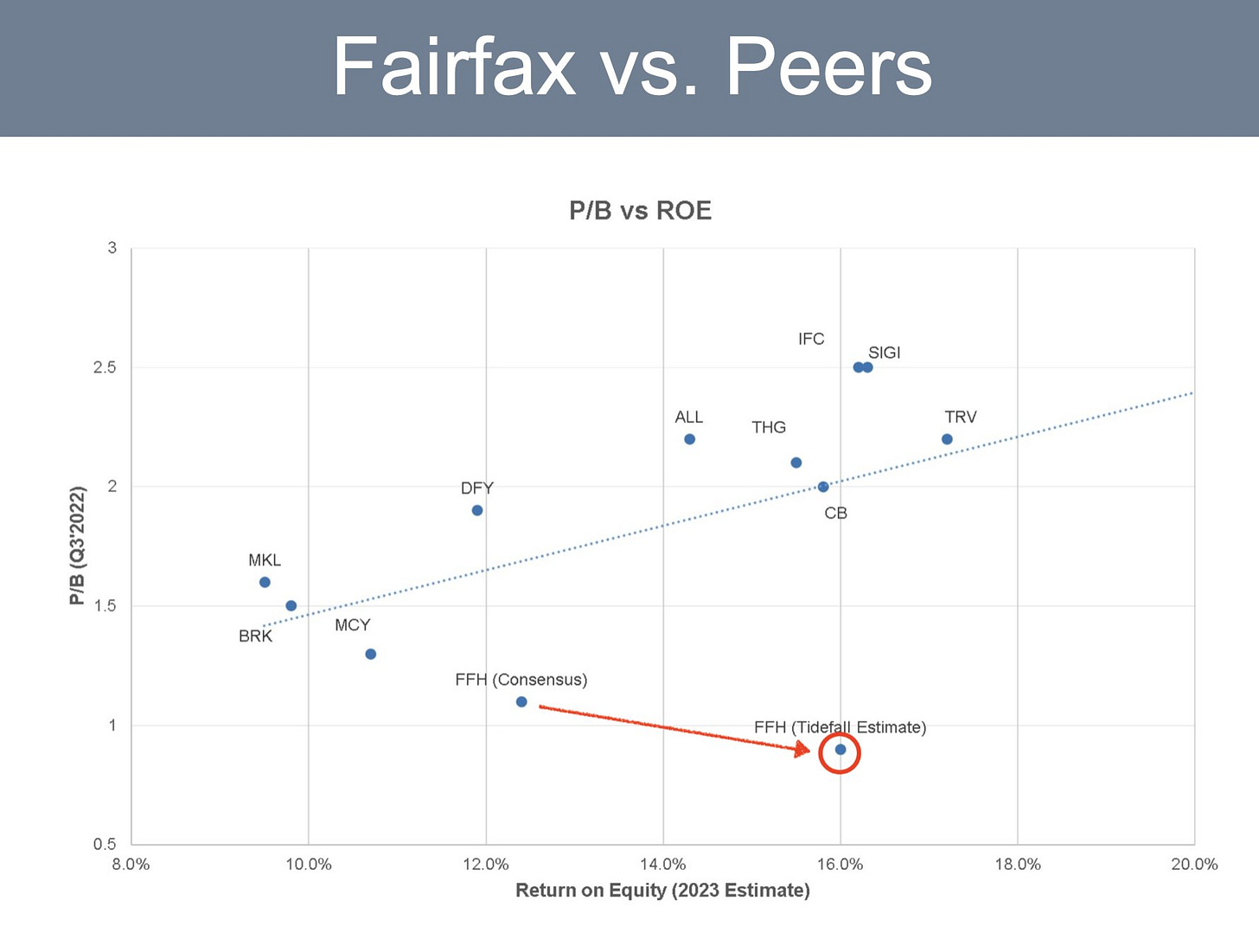

Fairfax has gone through a total transformation that Bay Street is finally starting to pick up on (Wall Street pays even less attention due to its OTC listing) I presented Fairfax at the Toronto CFA Society Annual Equity Symposium on January 31st, I’ll throw some of my slides up here. The stock’s moved higher from when the slides were made but take a look at the first slide, it’s still very out of favor compared to its peers (Fairfax is the green p/b line).

I’d love to take a modicum of credit for highlighting the name, but again Tidefall is relatively unknown…

Edgepoint however is very well known and they managed to put out a quarterly letter in January on Fairfax that was more succinct than anything I could ever write. If you want to read anything about Fairfax, just read the Edgepoint letter, that got people interested, (their charts are far prettier too!)

Well that, and the fact that Fairfax is now pumping out cash!

Let’s dive in.

Prem highlights the duration of their bond portfolio. Fairfax wisely avoided buying overvalued long duration bonds which as we saw this week can wreck a company’s balance sheet.

“…we were one of the few insurance companies in the world to have an increase in book value per share (up 6%) in 2022 while most of our competitors had a 10% – 30% decrease in book value per share, mainly due to the effect of rising interest rates on their fixed income portfolio.”

As I’ve mentioned before, the reduction of industry book value is likely pushing the hard market insurance longer than a normal cycle as it impairs their capacity to write policies.

The premiums growth at Fairfax has been incredible, doubling to $28b in just 5 years (and at a 96% combined ratio).

Prem really lays it all out here (as he did on the conference call).

Fairfax is likely going to be printing cash if rates stay high and insurance remains with in its historical norms. Prem specifically lays down a base case of $100 in earnings per share before investment gains. The stock is $653 today; yes, the expected earnings yield is massive.

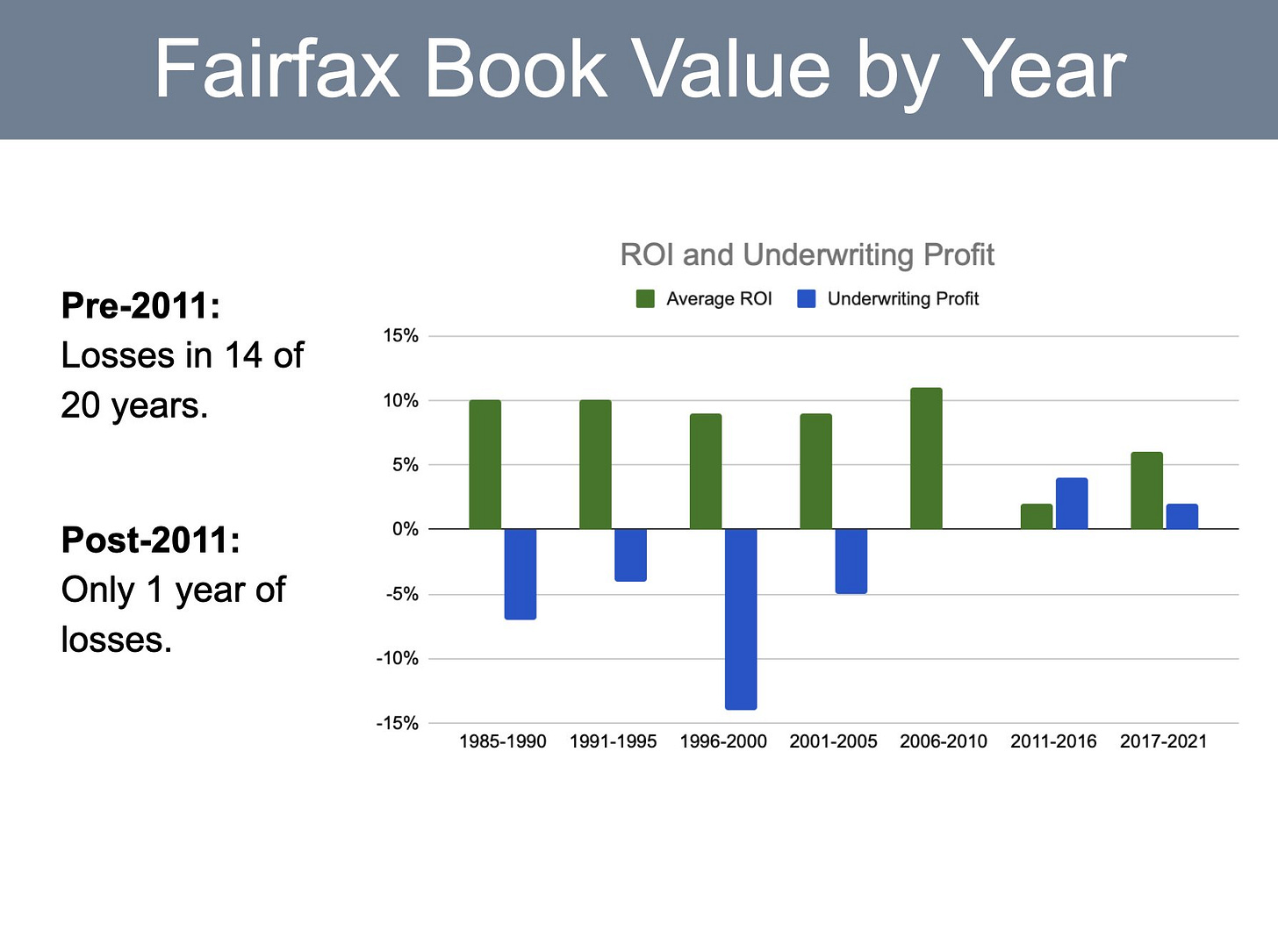

The other line here that I think is significant and that some readers might miss is that Fairfax will ‘focus on our operating income’ this is in reference to the hopefully more steady interest income and underwriting profits but also the increasing number of controlled businesses that Fairfax owns that will provide a more consistent earnings stream like Berkshire has and Markel is building out with Markel Ventures. Analysts love these types of cashflows compared to whipsaw gains/losses of prior years. The recent acquisition of Recipe Unlimited is a good example where a major chunk of its profits are high margin, steady franchise royalties. Fairfax shareholders will now be able to enjoy their meals at the restaurants below knowing a small piece of the profits goes right back to them. (My favourite one is Fresh on Front Street East, order the quinoa onion rings.)

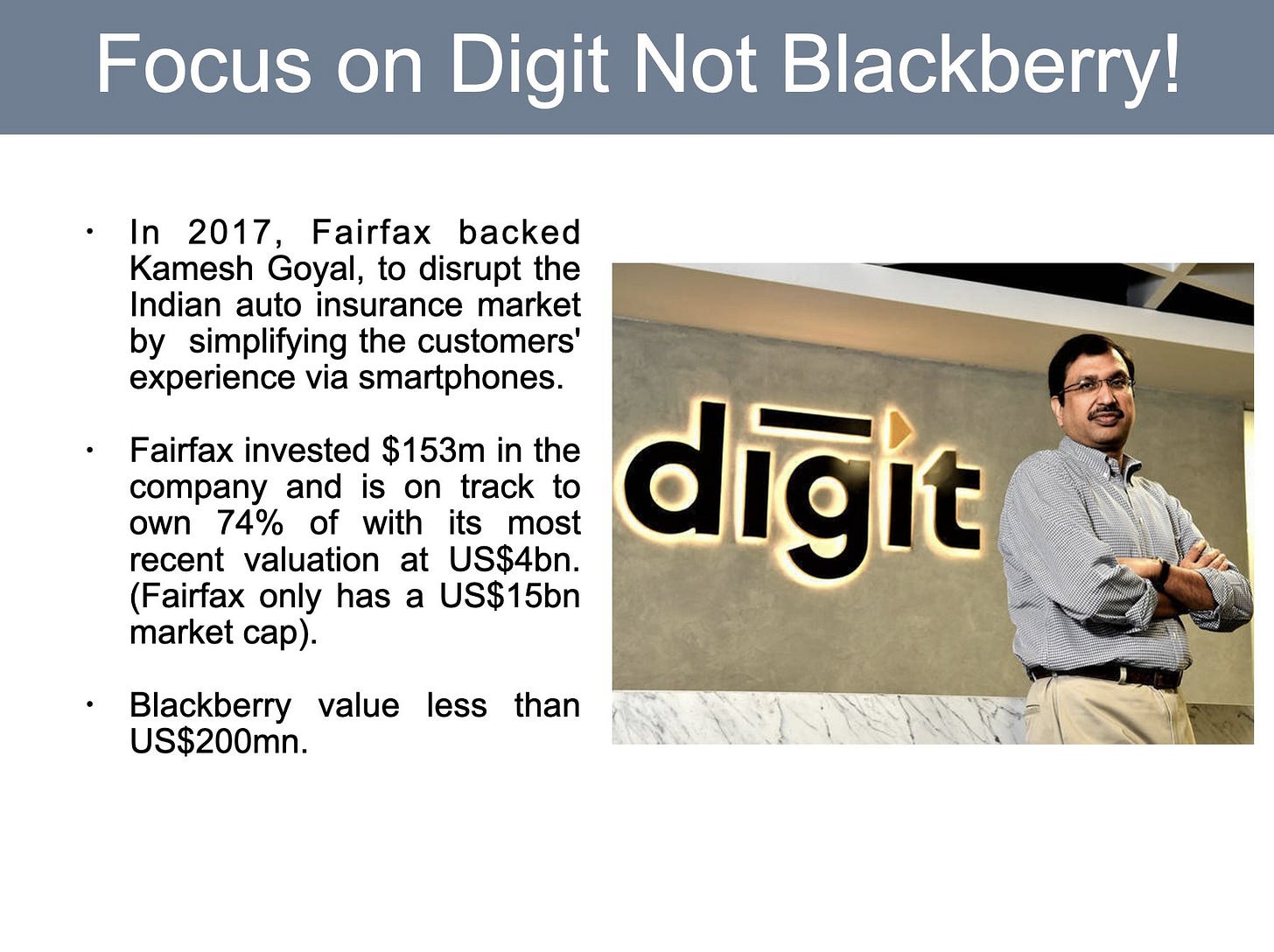

Prem talks about Digit which is now in the Fortune 500 of India. Digit is totally overlooked in the context of Fairfax (likely because it’s in India and shareholders are in Canada) but if equity markets there stay strong, Digit will likely IPO this year at a monster price to book and result in a massive windfall for Fairfax, further bumping its book value and freeing up liquidity.

Prem discusses his view of the markets towards the end of the letter recalling how he said 2021 was the renaissance of value investing. He kind of nailed this market view last year so it’s a well deserved (although long delayed) victory lap.

I also had this chart in my CFA presentation; value might be back!

Prem is very much in the “hard landing” macro view (which I lean towards as well).

Prem continues the letter by highlighting the bull case for India and the exceptional longterm track record of the company.

Prem casually drops C$1375 (US $1000) as a share price, 52% above today’s, as the level where the compounding in the stock price would match the compounding in book value, again this is not his estimate of intrinsic value but it’s interesting that he put it down in writing, both Fairfax and Fairfax India have active buybacks and Prem has not taken off the swap on his own shares yet (he’s up over half a billion dollars on it so far).

The letter goes pretty deep and there are lots of small finds so just read the entire thing if you like but these were some of my highlights.

The Fairfax India letter is out now as well but we just covered that in our Q4 letter.

Anyways, year 4 at Tidefall is underway!

I’ll be at the Fairfax and Berkshire AGMs this spring, feel free to say hello!

Trevor

I liked the fact you asked to be edited prior to posting this Trevor. Sincerely; Steve Leach

Interesting writeup. On Fairfax India, do you have any idea what management would do with the windfall proceeds in the event of a successful IPO of Bangalore Airport?